Preface

To get an insight into the marine shipping industry of Bangladesh and its neighbouring region, we need to visit to the distant past. We need to focus on ancient Indian history.

Persian historian Hamza al-Isfahani in the fifth century had witnessed Indian ships anchored in the Euphrates river. Those ships were then supervised by some merchandisers of Sindh and Gujrat.

World explorer Marco Polo, while visiting India in the 13th century, became amazed by shipbuilding techniques practiced in the region. He described that each of the big vessels carried at least 10 small boats like today’s lifeboat. There were 60 well-decorated cabins beneath the weather deck. Some other European explorers also described the glorious chapter of the shipbuilding industry in the region. Italian merchant Niccolò de’ Conti admitted that Indian ships were larger than the Italian ones.

The Indian subcontinent continued to dominate the marine shipping industry till the 17th century. But the scene began to change with the defeat of Nawab Sirajuddaula in the battle of Plassey and the defeat of Tipu Sultan in the Mysore war. Although the trade by sea was growing, locals were losing control over it. Pioneers of the marine shipping industry had been going out of sight one by one. Restrictions were once made to prevent the entry of any Indian ship without a British sailor to the Port of London.

Attempts like these were taken to shutter the local shipbuilding industry. Due to the preferable ecosystem though, the shipbuilding industry had not been destroyed completely in the region. Rather, it survived as a minor industry. Some of the old statistics prove the statement. There were around 80 registered shipping companies in India between 1836 and 1918. The number of companies declined to only seven by 1946. Only the small-range companies could survive that time.

After the partition in 1947, the Pakistan Steam Navigation Company was the sole private-run marine shipping enterprise in the then East Pakistan. AK Khan founded the Chattogram-based company that had two marine ships–Fatehabad and Jahangirabad. Both of the ships retired in 1969. After the 1971 Liberation War, the Pakistan government took back all ships of Pakistan National Shipping Corporation to its inventory. As a result, Bangladesh had lost ship both in the public and private sectors after its independence.

Reconstruction phase

There was the sea as well as seaports but no marine ship. It was the ground reality in the newly independent Bangladesh. And there was no alternative to restart the marine shipping for the import and export of food, fuel, edible oil, tea, hide, chemicals etc. Moreover, Bangladesh, being a coastal as well as a riverine country, had to facilitate transport of local and foreign goods by the sea. Considering this fact, Bangladesh Shipping Corporation (BSC) was established on 5 February 1972 by a presidential order. An organisation was formed without a ship. The government then put attention to collect ships. After five months of its establishment, BSC had its first-ever ship in the fleet. Then more ships were added to the fleet. Gradually, the number of ships in the BSC fleet stood at 38.

As the government was set to open up the private sector, private investors became interested in the sector. The first private seagoing ship arrived in the country in the late 1970s. Later on, private investment in this sector gained momentum. New ventures started to register their name in shipping. The number of ships continued to increase. After five decades of independence, it can be said now that Bangladesh is on the track to become a maritime nation. At present, a total of 62 sea going ships are now transporting goods in the blue ocean.

The golden episode of public sector

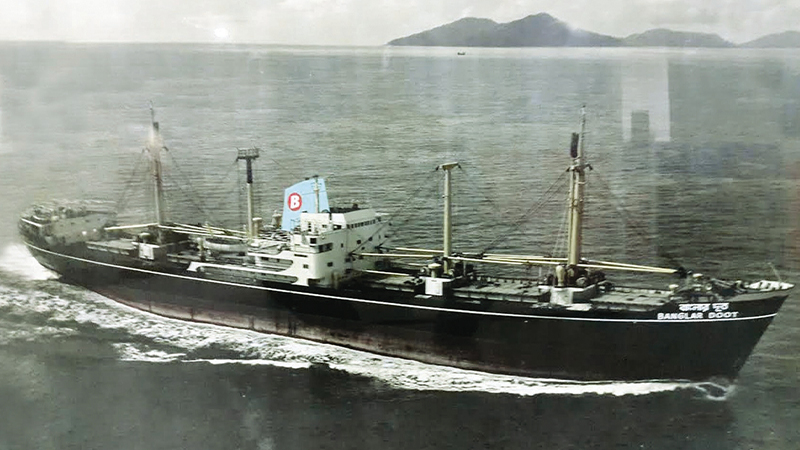

Since no ship was at its fleet, BSC initially started working as an agent for some seagoing ships. After five months of formation, the first ship ‘Banglar Doot’ with a capacity of 12,812 DWT was added to BSC fleet. Around the time, another ship called ‘Banglar Sampad’ was added. Onward, the BSC had been adding more ships to its fleet. Within 10 years, the number of ships in the BSC fleet stood at 27. In 1991, BSC had 38 ships. It was the golden chapter in the history of BSC.

Time to turn around

After 1991, no new ship was added to the BSC fleet for long period of time. Meanwhile, the existing vessels’ lifespan was being shortened, so were they losing capacity. Gradually, the size of the BSC fleet became smaller. The number of ships dropped to 13 in the 2012-13 fiscal. As the BSC was incurring losses, five of its vessels were sold the next year. Following the decreasing trend, BSC had only two ships in its fleet in 2018.

However, the incumbent government took initiative to make BSC vibrating again. Following this, BSC has procured six ships from China at a cost of around BDT 1,737 crore.

Among the new ships, there were three product tankers and three bulk carriers. The ships have also been commissioned to operate in the marine transshipment. Including two tankers, there are eight ocean-going ships in the BSC fleet at present.

Plan for more ships

Currently, the BSC has set its vision to explore the horizon. BSC wants to become one of the leading shipping companies in Southeast Asia. Given the ambition, plans have been made to purchase more ships in the future to strengthen the BSC fleet. The plans include the purchase of two mother bulk carriers of 80,000 tons and 10 bulk carriers with a capacity of 10,000-15,000 tons. Apart from this, Eastern Refinery Limited has a plan to purchase two mother tankers with a capacity of 100,000 to 125,000 tons each for crude oil transportation. Moreover, the authorities concerned are going to purchase two mother product oil tankers with a capacity of 80,000 tons so that the Bangladesh Petroleum Corporation-imported diesel and jet fuel can be transported.

The government is importing LNG to meet the growing demand of fuel. To transport the imported LNG by Bangladeshi vessels, the government has taken an initial plan to add two LNG vessels with a capacity of about 140,000 cubic metres, two of about 174,000 cubic metres and two more of 180,000 cubic metres to the BSC fleet.

Discussions are underway to introduce feeder services among the BIMSTEC member countries. To support the initiative, another project has been undertaken to procure four new cellular container vessels with a capacity of 1,200 to 1,500 TEU each. The Denmark government will support building the cellular container vessels. If the projects are implemented successfully, it can be said undoubtedly that the Bangladesh Shipping Corporation will be graduated into a self-reliant international shipping company.

Foundation of private sector

No other private marine shipping took to the ground in the pre-independent period. Even for a long time after Bangladesh’s emergence, the state-run Bangladesh Shipping Corporation remained as the sole marine shipping organisation. Although new ships were added to the BSC fleet, no initiative was seen in the private sector during this time. There was a logical reason behind this.

The nationalisation of industry policy of the post-independence government put an impact in this regard. Later, as the private sector began to open up, interest in the ocean-going ship industry, like other ones, began to grow. Sanaullah Chowdhury was a pioneer of private investment in the ocean-going ship industry. Sanaullah, who joined Shaw Wallace (Pakistan) Limited in 1955 as an apprentice, soon attracted the attention of the higher officials of the Germany-based shipping company Hansa Lines. He got an opportunity of training from Hansa Lines headquarters in Bremen.

Sanaullah Chowdhury returned to Bangladesh after gaining extensive knowledge about the shipping industry in Germany, the Netherlands and Belgium. In 1966, he left his job at Shaw Wallace and established Atlas Shipping Service as a family business. Soon after Bangladesh’s independence, his venture became an agent of Scindia Steam Navigation of India and India Steamship Company. A few years later, he also became an agent of the Shipping Corporation of India. Gradually, he evolved his business as diversified by agency, chartering, brokerage and other.

But Sanaullah Chowdhury’s dream was much bigger. His dream realised in 1978 by opening a new chapter in the private shipping business in Bangladesh. Atlas Shipping bought an old ship of 10,000 GRT (Gross Register Tonnage) and started a marine shipping business.

A ship named Al-Salma got registered with the Chattogram Port. This was the first-ever private-run ocean-going ship in Bangladesh. Later on, Sanaullah added more ships to his company’s fleet while selling out the older ones as scraps. To the Atlas Shipping’s fleet, Al-Sharmeen was added in 1980, Al-Shayesta in 1981, Al-Sana and Al-Salma-2 in 1985, Al-Shamrooz in 1986, Safar in 1989 and Al-Salmas in 1997. The company’s last ship was Safar which was sold as scrap in 1999. By selling the Safar, the shipping company closed forever.

Atlas Shipping’s ships were used to sail east from Japan to South Korea and west from Pakistan to the Persian Gulf. The company saved huge amount of money by hiring Bangladeshi sailors. Yet many Bangladeshi mariners working around the world had begun their career with Atlas Shipping.

After the Atlas Shipping, Abul Khair Chowdhury’s Samudra Jatra Shipping, Wasiur Rahman Chowdhury’s Aquatic Shipping, Abdul Awal Mintu’s Bengal Shipping and Shah Alam’s Continental Liner joined the shipping industry.

Private-run shipping is dominating now

Pioneered by Sanaullah Chowdhury, currently, more than 10 private-run companies operating marine ships on international routes. The member companies of Bangladesh Ocean Going Ship Owners Association are–SR Shipping owned by the Chattogram-based industrial group KSRM; Akij Shipping Limited owned by Akij Group, the state-run Bangladesh Shipping Corporation; Meghna Group; MI Cement; Vanguard Maritime Limited; Bashundhara Logistics owned by Bashundhara Group; BSA Shipping Limited; East Coast Shipping Lines owned by East Coast Group; Orion Oil and Shipping Limited owned by Orion Group; and HR Lines owned by Karnaphuli Group.

Apart from these companies, several others had been operating ships on international routes. However, their ships are not transporting goods at present.

Ranking

Among the private-run seagoing shipping companies, the SR Shipping–owned by Chattogram-based KSRM Group that had invested first time in the sector in 2004–is the most advanced one. The MV Fatema Zahan was the first ship in the SR Shipping’s fleet. At present, the shipping company owns 22 ships. Registered as Bangladeshi flag carriers, all the SR Shipping’s ships are now transporting bulk products. The largest marine ship in the company’s fleet is the MV Nazia Jahan. The bulk carrier of 58,110 deadweight tonnage was built in 2010.

After the SR Shipping, Akij Shipping Line Limited, owned by Akij Group, has the largest number of ships in the fleet. Launched in 2010 as a subsidiary of the Akij Group, Akij Shipping Line Limited currently owns 10 seagoing vessels in its fleet, all of which are bulk carriers.

According to the company’s website, Akij Glory, Akij Heritage, Akij Pearl, Akij Ocean, Akij Noor, Akij Wave and Akij Globe are the busiest among others. The ships, each of 76,302 deadweight tonnage, are all built in Japan in 2006. Besides, there is also a cargo ship named Akij Nobel of 58,710 deadweight tonnage in the 10 year-old Akij Shipping’s fleet. The cargo ship was too built in 2006. The two other ships in the company’s fleet are Akij Moon and Akij Star.

Meghna Group, one of the leading business groups in the country, has been operating the shipping business for more than four decades. The Meghna Group owns a total of seven ocean-going ships–MV Meghna Paradise, MV Meghna Rose, MV Meghna Energy, MV Meghna Adventure, MV Meghna Harmony, MT Meghna Pride and MT Meghna Trader.

Another Chattogram-based industrial group MI Cement Factory also has a separate shipping business. The company currently operates four seagoing ships in its fleet. With the MV Crown Victory, MV Crown Voyager, MV Crown Vision and MV Crown Virtue, the MI Cement Factory Limited has been operating its shipping business.

Besides, there are three seagoing ships owned by Vanguard Maritime Limited. The Chattogram-based company is transporting goods by sea through the ships named Grand Royal, Star Royal and Grand Royal.

Considering the growing demand, Bashundhara Logistics was established in 2004 by Bashundhara Group, one of the leading industrial families in the country. Although the company has a large fleet of lighter ships, the number of seagoing ships it owns is minimal. At present, the company owns two seagoing vessels–Bashundhara-6 and Bashundhara-8.

Apart from these, a Chattogram-based company BSA Shipping Limited operates two ocean-going ships named Brief Royal and Great Royal and East Coast Shipping Line operates MT Omera Queen and MT Omera Legacy. And Orion Oil and Shipping Limited has Orion Express while HRC Shipping owns Sahare and Sarera.

Reasons behind private investment

The country’s economy has changed remarkably in the last decade. Industrial development, establishment of new economic zones, policy support by the government and some big development projects have reshaped the economy. As the consequences, imports to and exports from Bangladesh have multiplied. Taking advantage of this opportunity, the private investors are leaning towards the marine shipping business to transport their own as well as the other’s goods. Policy support by the government has also helped to attract private investment in the industry. The government is favouring duty waivers for the import of seagoing ships. Due to government policy, the importers do not have to pay any duty on the import of ships less than 22 years old and of 5,000 deadweight tonnage. Earlier, importers had to pay about 27 per cent duty while importing seagoing ships. Due to the costly tariff, businesses did not show much interest in investing in this sector. For the same reason, many marine ship owners were discouraged from registering their vessels in Bangladesh.

Another reason behind the recent surge in the imports of the marine ship is the falling price of ships because of the COVID-19 pandemic. Considering the situation as a privilege, registration for ships in Bangladesh has increased at a remarkable rate in the last eight months. Besides, hassle-free registration, low-paid experienced mariners, and the obligation to transport 50 per cent of the goods on Bangladeshi flagged ships are contributing to the development of the sector.

Year-wise number of vessels

In 15 years since 2005, Bangladesh saw the highest number of ocean-going ships carrying the native flag during the years of 2011, 2012 and 2013. In these three years, there were the highest 67 ships. According to the statistics of the mercantile marine office under the shipping department, 31 marine vessels were engaged in transporting goods in 2005, 28 in 2006, 27 in 2007, 27 in 2008, 34 in 2009, 46 in 2010, 63 in 2014 and 47 in 2015.

Among the subsequent years, 45 marine vessels were engaged in cargo transport in 2016, 36 in 2017, 37 in 2018, 47 in 2019 and 62 in 2020.

Registered ships

According to the mercantile marine office, there are 62 Bangladeshi flag carrier ships in total including eight of Bangladesh Shipping Corporation currently engaged in cargo transport on international routes. The ships include Bangladesh Shipping Corporation-owned Banglar Jyoti and Banglar Saurabh. The two ships got registration in 1988. The other ships that had been registered in the following next two decades are not in operation at present. Twenty years after 1988, three ships got registration in 2009. Later on, three more were registered as marine vessels in 2010, seven in 2011, one in 2012, nine in 2013, four in 2014, three in 2016, two in 2017, four in 2018, 11 in 2019 and 11 in 2020. After the year 2013, the highest number of marine vessels got registered in 2019 and 2020. The good news for this sector is that six ships have been registered in Bangladesh recently amid the COVID-19 pandemic.

A new cruise with container ship

After Bangladesh’s independence, Sanaullah Chowdhury pioneered private-run marine shipping in 1978. But all the Bangladeshi flag-carrying seagoing ships in the following 20 years were bulk carriers and oil tankers. Although container handling at the Chattogram port started in 1976, no Bangladeshi company-owned container ship that time. During 1996-1998, about a decade after the start of container transport in import and export, Bangladesh stepped in seagoing container shipping thanked to the HRC Shipping Company and QC Shipping Line. HRC had 10 container ships while QC had seven during their operational period. However, QC stepped back from container shipping in 2007, so did HRC Shipping in 2010 due to the global recession, high operational cost and other issues. For the next 12 years, no local company engaged in container shipping. As a result, local importers had no other option but to rely on foreign ships to transport the containers for the entire period. Foreign shipping lines fully cashed in the freight charges while transporting the containers.

Given the steady increase of container shipment centring the Chattogram Port, the private-run Karnaphuli Limited has initiated to bring back the lost heritage. Karnaphuli Group-owned HR Lines, with an investment of Tk116 crore (1.16 billion), has started operating two container ships Sahare and Sarera on the Chattogram port-Singapore-Port Klang, Malaysia, routes. On regular basis, the container ships capable of transporting 1,550 TEU containers are transporting goods on these routes.

Increasing income opportunity

For several recent years, the demand curve of the ocean-going ships for facilitating import-export in Bangladesh has been quite upward. Data suggests that Bangladesh dealt with maritime shipping of export-and-import of 18,148,000 tonnes of goods maximum during the 1999-20 fiscal. In the 2017-18 fiscal, the amount of export-import goods stood at 94,764,000 tons. In that long time, the transport of import-export goods reduced only once and the time was the 2011-12 fiscal year.

In that particular fiscal, maritime shipment of goods centring Bangladesh fell to 43,541,000 tons compared to that of 46,691,000 tons of the previous fiscal. With this exception, the trend of Bangladesh’s maritime import and export seems growing.

Consequently, the demand for seagoing ships is increasing too. More enthusiastic companies have been investing in the maritime shipping sector and new ships getting registered in Bangladeshi ports to capitalise on the growing demand of service.

According to the United Nations Conference for Trade and Development (UNCTAD), the size of Bangladesh’s shipping industry market was around USD 1.72 billion (172 crore) in 2005. The market size expanded to USD 6.98 billion (698 crore) by 2017. Currently, the shipping industry market is even bigger.

However, foreigners used to occupy the lion share of Bangladesh’s market for many years because the country lacked seagoing ships. Although the situation has improved a little, revenue earning by the Bangladeshi flag carrying ships has been increased.

UNCTAD data shows that overseas shipping lines had earned USD 1.59 billion (159.70 crore) by maritime export and import for Bangladesh in 2005. The domination of the overseas shipping lines over the Bangladesh-based export-import has intensified steadily. Revenues of the overseas companies from Bangladesh increased to USD 3.44 billion (344.20 crore) in 2010. In 2015 and 2017, they earned USD 5.77 billion (577.40 crore) and USD 6.48 billion (648.60 crore) respectively from Bangladesh.

With the inclusion of more local companies in this sector, Bangladesh’s market share in marine shipping has increased more than ever. According to UNCTAD, revenue earning by the Bangladeshi shipping companies was only USD 122 million (12.20 crore) in 2005. In 2017, the amount stood at USD 500 million (50 crore). The obligation to transport 50 per cent of the local products through Bangladeshi flag carriers gives strength to the local shipping lines to grab the business opportunities.

Although the private-run Bangladeshi flag carriers can earn more from the maritime export and import, the state-owned Bangladesh Shipping Corporation for long was driven in the opposite direction. BSC, though, made USD 52 million (5.20 crore) in 2005, had earned USD 12.6 million (12,660,000) in 2017. However, officials are expecting that BSC’s revenue would be increased a bit as the new six ships have been added to its fleet while procurement of some more ships is underway.

Conclusion

After a long period of backlog, Bangladesh’s marine shipping industry has stepped on the track to explore the horizon. Actually, the private sector is prompting the expansion of Bangladeshi fleets. This ongoing development has also boosted Bangladesh’s position in the International Maritime Organisation (IMO). The logic is too simple. The greater a country has its marine vessels’ Gross Register Tonnage (GRT), the greater the status of that country with the International Maritime Organisation. Considering Bangladesh’s development in the particular sector, it can be said that Bangladesh is on the right track to becoming a maritime nation.

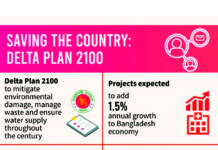

Most important thing is that an opportunity has been created by the local shipping companies to save huge amounts of money while paying the overseas shipping companies as freight charges. Because Bangladeshi merchandisers have to pay USD 8-9 billion as freight charge each year. When the country lacked local ships, there was a mere scope to save only 2 per cent of the charges. As the number of Bangladeshi flag carrying ships increases, an opportunity is being created to claim local share into the freight charges. Marine shipping industry experts now say that additional 2 per cent GDP growth in the national economy will be possible every year if the potentials of marine shipping are fully exploited

.